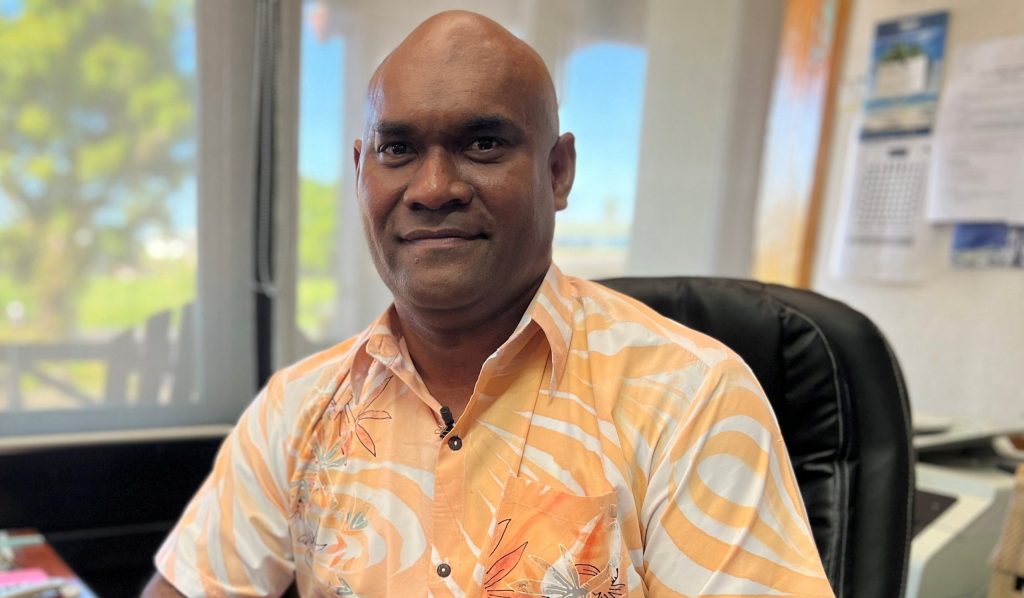

FNU Pro-Vice-Chancellor TVET Dr Isimeli Tagicakiverata.

The Fiji National University (FNU) remains committed to supporting Fiji’s vital tourism sector and continues to work closely with industry partners to ensure that our courses and qualifications are relevant and beneficial.

Pro-Vice-Chancellor TVET, Dr Isimeli Tagicakiverata, said FNU has been proactive in its approach to addressing the skills gap in the tourism industry, and the university is continuously consulting with industry partners to design and implement programmes that meet the evolving needs of the sector.

Dr Tagicakiverata comments follows concerns raised by the Fiji Hotel and Tourism Association (FHTA) CEO, Fantasha Lockington, regarding the FNU levy and the inadequacy of training provided by FNU to tourism industry workers.

“Our curriculum is regularly reviewed and updated in collaboration with industry experts to ensure that graduates are equipped with the practical skills and knowledge required in the workforce,” he said.

“Over 10,700 were trained by FNU in hospitality and tourism courses from 2018-2023. These courses include cookery, baking and pâtisserie, bar services, house keeping, beauty therapy, hairdressing and many more. This shows our commitment to the industry even after Levy was taken away in 2018.”

He added that FNU has established strategic partnerships and these collaborations have led to the development of specialised training programmes and industry certifications tailored to the specific needs of industry partners.

“We understand that some employers prefer to conduct in-house training tailored to their specific operational needs. We support this initiative and encourage employers to utilise these funds to enhance their training programmes with us, ensuring that they meet the high standards required by the industry,” said Dr Tagicakiverata.

He said not all tourism operators have registered for the FNU Levy to take advantage of the services we provide.

“All the Levy paying employers can claim for internal training ‘Inhouse trainings’ provided to their employees through the Method A or Method B Grant Claim schemes.”

However, with the restructure of Levy in 2018/2019 budget, employers can only claim less than 10% of levies paid by them as training grants while 40% is redistributed to ACCF and 50% is redistributed to Ministry of Finance for the expansion of private medical scheme.